My husband looked at me like I had lost my mind. “A debit card? For a first grader? He still believes in the Tooth Fairy!”

I get it. Giving a 6-year-old a debit sounds like a recipe for disaster—or at least a very expensive accidental purchase of $200 worth of Roblox credits. But we were stuck in a cycle of “Mom, can I have this?” at every checkout line, and the “chore chart” on our fridge was gathering more dust than checkmarks.

I realized we were teaching him that money was something that just magically appeared from Mom’s purse. So, we decided to try something different. We signed him up for Greenlight.

The First 24 Hours: The “Chore Revolution”

The day the card arrived with his name on it, something shifted. He didn’t see it as a toy; he saw it as a badge of adulthood.

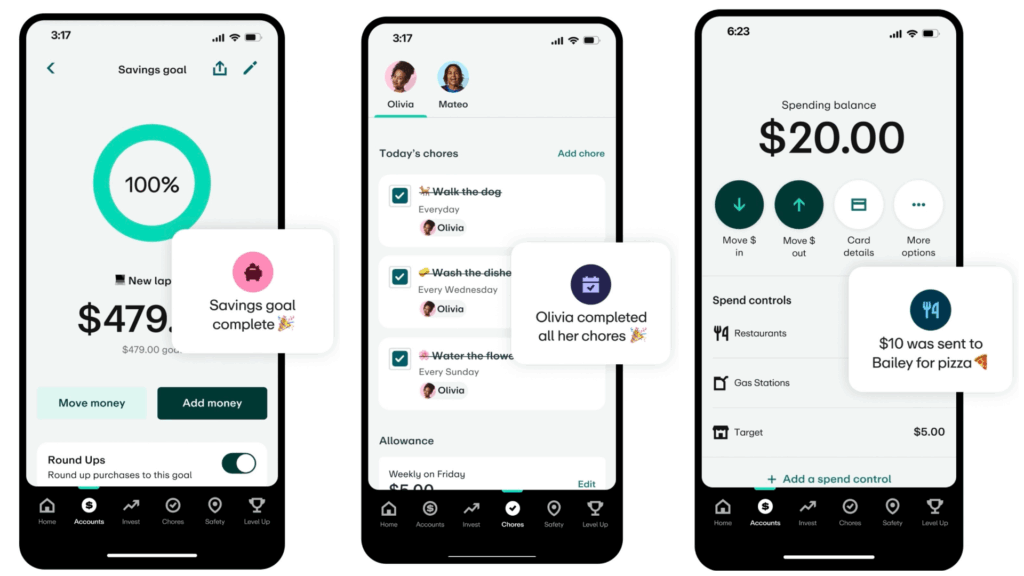

We sat down and opened the Greenlight app together. I set up a few age-appropriate chores: clearing his plate, putting his shoes away, and feeding the dog. For the first time ever, I didn’t have to nag. In fact, I caught him taking out the trash without even being asked.

When I asked him why, he looked at me with total focus and said, “I need to check it off in my app so I can get paid.”

The real “aha!” moment happened a week later at the store. He saw a toy he really wanted, but instead of the usual “Please, can I have it?”, I simply said, “Check your Greenlight balance. Do you have enough?”

He pulled out his card, we checked the app, and he realized he was $10 short.

In the past, that would have led to a meltdown. Instead, he looked at the toy, put it back on the shelf, and said, “I’m going to go home and see if there are more chores I can do.” I nearly fell over. He wasn’t just spending; he was planning.

The Best Parenting Decision We’ve Made

It sounds early, but the habits are sticking. Greenlight makes it so simple:

- The “Earn” Tab: He sees exactly what he needs to do to earn his allowance.

- Instant Transfers: No more hunting for loose change; I send money straight from my phone to his card.

- The Safety Net: I have total control. I get an alert the second he spends a dime, and I can turn the card off instantly if it gets lost.

We are amazed at how responsible he’s been. It’s empowering for him to feel like a grown-up, and it’s teaching him more about the value of a dollar than I ever learned at that age.

Research even shows that children with any savings at all are 4.5 times more likely to graduate college. By giving him a Greenlight card, I’m not just giving him a way to buy snacks—I’m giving him financial independence.

If you’re tired of the “allowance wars” and want to raise a kid who actually understands how money works, don’t wait until they’re teenagers.